Mesa AZ Bankruptcy Attorney

Looking for a Mesa AZ bankruptcy attorney usually means the pressure is real—creditor calls, a lawsuit, a garnishment notice, or the fear of losing a vehicle you rely on every day. Most people don’t wake up “wanting” bankruptcy. They want the stress to stop and a plan that makes sense.

We help individuals and families in Mesa and the East Valley understand their options and take the next step with confidence. Virtual consultations are always an option if that’s easier, and we’ll tell you plainly whether bankruptcy is the right tool—or whether another approach makes more sense.

Mesa Bankruptcy Attorney Consultation Snapshot

A good consultation should feel practical and grounded—less like a sales pitch, and more like a clear “here’s where you stand” conversation. Here’s what we focus on in a first meeting so you can leave with a plan (or at least the next right step).

- Clarity fast: what bankruptcy can realistically fix in your situation, and what it won’t.

- Strategy and timing: how to avoid common pitfalls before you file.

- Respectful process: no judgment, no lectures—just straightforward answers.

- Help across Arizona: we serve clients statewide, with in-person and virtual meetings available at your convenience.

If you’d like, tell us what’s going on and we’ll help you identify the best next step—whether that’s bankruptcy or another option.

Choosing a Bankruptcy Attorney in Mesa

When you’re searching for a bankruptcy attorney mesa az residents can trust, it helps to think beyond “who can file the paperwork.” A strong bankruptcy lawyer should help you make good decisions before you file— because timing, documentation, and strategy can affect what you keep, what you pay, and how smooth the process feels.

Here are a few practical things to look for when comparing attorneys in Mesa:

- Clear expectations: You should walk away understanding the likely timeline, the steps ahead, and what “success” looks like for your specific goals (stopping garnishment, catching up a car, protecting equity, etc.).

- Up-front document guidance: A good office tells you exactly what matters most (pay stubs, tax returns, bank statements, vehicle info, lawsuits/garnishments) and why—so you’re not scrambling later.

- Risk spotting: The attorney should ask about common “gotchas” (recent transfers, using credit before filing, cashing out retirement, large tax refunds, or selling property) and explain how to avoid problems.

- Responsiveness and plain-English answers: Bankruptcy is stressful. You shouldn’t feel in the dark or talked down to.

Attorney Casey Yontz has practiced bankruptcy law for over 18 years and has handled thousands of bankruptcy matters. The benefit of that experience is straightforward: we’ve seen the patterns, we know where people get tripped up, and we focus on helping you avoid preventable mistakes while keeping the process respectful and efficient.

If you’d like, we can start with a quick, practical review of your situation— what bankruptcy can realistically fix, what it won’t, and what timing decisions matter most—so you can decide the next step with confidence.

Common Debt Pressures We See in Mesa

People searching for bankruptcy lawyers mesa usually aren’t doing it “just because.” Something changed—income dropped, expenses spiked, a lawsuit showed up, or a garnishment hit at the worst possible time. Below are some of the most common debt pressures we hear about in Mesa and the East Valley, along with the first practical steps that often help.

- Collections and lawsuits: creditor suits, judgments, and the stress of court paperwork.Helpful next step: Don’t ignore a lawsuit—even if you can’t pay. Deadlines matter. Save any summons/complaint paperwork and write down the dates on the documents so you can get accurate advice quickly.

- Wage garnishments: money being taken from each paycheck and the urgency that creates.Helpful next step: Gather your most recent pay stubs and any garnishment paperwork. Timing can be important when the goal is to stop (or prevent) a garnishment and stabilize your budget.

- Medical and family expenses: bills that snowball into collections.Helpful next step: Make a simple list of providers, approximate balances, and which accounts are already in collections. That snapshot helps you evaluate options without spending hours gathering every statement first.

- Vehicle payment stress: the risk of repossession when transportation is non-negotiable.Helpful next step: Find your lender name, monthly payment, and whether you’re behind (and by how much). If keeping the car is a priority, the strategy can look different depending on the loan status and your overall budget.

- Credit card overload: balances that keep growing even when you’re doing “everything right.”Helpful next step: Write down your total monthly minimum payments versus what’s realistically left after essentials. That one comparison often makes it clearer whether a reset option is worth exploring.

Quick guardrail: If you’re thinking about bankruptcy, try to avoid last-minute moves that can create complications—like transferring property to family, draining retirement accounts, or running up new credit. A short consultation can often clarify what’s safe and what to pause.

Mesa Economy Snapshot

Mesa’s workforce is broad—and that variety shows up in real-life budget stress. In consultations, we often meet people whose finances changed because of fluctuating hours, overtime that dried up, contract work, seasonal schedules, or rising household costs. This matters because income patterns can affect timing, paperwork, and eligibility in a bankruptcy case.

- Key local industries: Mesa’s economic development priorities include healthcare, education, and aerospace/aviation/defense (among other targeted sectors). City of Mesa: Industries

- Large employers: Mesa’s major employers include Mesa Public Schools, Banner Health, the City of Mesa, The Boeing Company, and Dexcom. City of Mesa: Major Employers

- Why it matters for bankruptcy: If your pay varies (overtime, bonuses, contract work, or reduced hours), the “lookback” income period and documentation can make the process feel confusing. A quick review can help you understand what numbers matter, what to gather, and whether timing could improve your options.

If you’re unsure how your income pattern affects eligibility or which path fits best, a consultation can bring clarity—without pressure. In-person and virtual meetings are available.

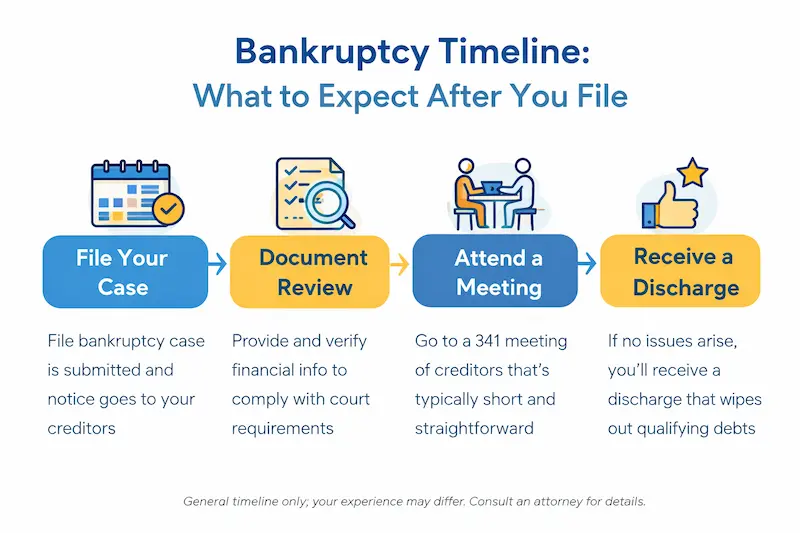

Bankruptcy Paths Mesa Residents Typically Compare

When Mesa clients start exploring bankruptcy, the decision usually isn’t “should I file?”—it’s which path actually matches the goal. Some people need a fast reset from unsecured debt, others need time to catch up on protected assets, and business owners sometimes need a different tool entirely. A thoughtful bankruptcy attorney in Mesa should explain the trade-offs in plain English (and what the paperwork will look like) before you commit.

We keep the detailed, in-depth breakdowns on our dedicated guides, which are the best “go-to” resources if you want to go deeper: Arizona Chapter 7 Guide and Arizona Chapter 13 Guide.

- Chapter 7: often considered when someone wants a clean financial reset and the eligibility numbers line up. (For a full explanation of who qualifies and what to expect, see our Arizona Chapter 7 Guide.)

- Chapter 13: often compared when someone needs time to catch up on certain obligations or protect assets through a court-approved monthly plan. (For the plan structure, common goals, and how eligibility works, see our Arizona Chapter 13 Guide.)

- Chapter 11: sometimes used by businesses, and occasionally by individuals who don’t fit within chapter 13’s debt limits but still need a structured reorganization approach. If you’re a business owner (or your debt levels are outside chapter 13’s limits), it’s worth asking whether a reorganization option makes more sense than forcing a “one-size-fits-all” plan.

Arizona Bankruptcy Guidance and Resources

Practical, plain-English guides for people across Arizona—built by a Phoenix-based bankruptcy law firm to help you understand your options and take the next step with confidence.

East Valley Timing Issues That Come Up Before Filing

Most bankruptcy “problems” aren’t about bad people or bad intentions—they’re about timing, paperwork, and a few common decisions that seem harmless in the moment. If you address these issues early, cases tend to run smoother, feel less stressful, and involve fewer surprises.

If you’re considering filing, a helpful rule of thumb is: pause major financial moves and get clarity before you act. Here are a few situations we see often in Mesa and across the East Valley that are usually easier to handle when you tackle them up front:

- Last-minute credit use: especially cash advances or unusually large charges.Why it matters: Recent credit activity can draw extra attention and create disputes in some situations. If bankruptcy is on the table, it’s usually safer to avoid non-essential credit use and ask what’s appropriate for necessities (food, utilities, basic transportation).

- Repaying a family member: “I just wanted to make them whole” can create avoidable issues.Why it matters: Payments to relatives (and certain close connections) can be reviewed differently than ordinary bills. Even when the intent is good, it can complicate timing and paperwork. It’s usually better to get guidance before making “cleanup” payments.

- Moving titles or assets: transfers done “for safekeeping” often backfire.Why it matters: Transfers can trigger questions and slow down an otherwise straightforward case—even if you didn’t mean anything by it. If you’re worried about an asset, ask about lawful ways to protect it instead of moving it around.

If any of these sound familiar, don’t panic—most situations are manageable. The point is to get clear guidance before filing so you avoid preventable headaches and keep your case as smooth as possible.

What Clients Say

Reaching out about bankruptcy usually happens at a stressful moment. Our goal is simple: clear explanations, calm guidance, and a process that feels respectful from start to finish. Here are a few short excerpts that reflect themes we hear often—professionalism, reduced stress through clarity, and patient answers.

Reliability note: These are short excerpts from client feedback (wording may be lightly shortened for length). Results vary, and past feedback can’t guarantee a future outcome.

Professional and Above-and-Beyond Service

“I was so impressed by the level of professionalism, and the service I experienced was consistently over and above all I could have asked.”

What this means for you: You should expect organized communication, clear next steps, and a process that doesn’t feel chaotic.

Less Anxiety

“You made the whole process less scary… thx for calming my anxiety.”

What this means for you: Bankruptcy is legal paperwork, but it’s also emotional. A good attorney should explain what’s happening, what’s next, and what you can stop worrying about today.

Clear Explanations

“He walked me step by step… explained every option… never made me feel stupid for asking questions.”

What this means for you: You should feel comfortable asking basic questions. You should also leave a consultation understanding the path you’re considering and why it fits your goal.

Serving Mesa and the East Valley

Your bankruptcy case is filed in the federal bankruptcy court, but the outcome is still shaped by Arizona-specific rules—especially when it comes to what you can protect. For example, Arizona Revised Statutes (A.R.S.) play a major role in determining which exemptions apply and what property you may be able to keep. That’s why local, Arizona-focused guidance matters just as much as knowing the federal process.

We serve Mesa and nearby East Valley communities and aim to make the process straightforward, respectful, and convenient.

We commonly work with clients in and around:

- Downtown Mesa

- East Mesa

- Dobson Ranch

- Las Sendas

- Red Mountain

- Mesa Riverview area

Appointments are available, and virtual consultations are always an option if that’s easier. If an in-person meeting is helpful, we can discuss what makes sense for your situation and schedule.

Helpful tip: If you’re booking a consultation, it helps to have your most recent pay stubs, your last tax return, and any lawsuit or garnishment paperwork handy. If you don’t have everything, don’t worry—we can still start with a clear plan for what to gather next.

What to Have Ready for Your Consultation Request

If you’ve made it this far, you’re probably not looking for generic advice—you want a clear plan. The goal of a consultation is to turn uncertainty into specific next steps: what option fits best, what it would look like in your situation, and what to do first.

You don’t need perfect paperwork to start. But if you have any of the items below, we can usually give you clearer answers faster and avoid back-and-forth:

- Income snapshot: recent pay stubs, benefits statements, or a quick summary of monthly income (especially if income changes month to month).

- Debt list: a list of creditors and collections, plus any lawsuits, judgments, or garnishment paperwork (if you have it).

- Housing and vehicle basics: monthly payment amounts, whether you’re behind, and (if you know it) the approximate payoff balance.

- Recent tax return (helpful, not required): if you have your most recent return handy, it can speed up eligibility and planning discussions.

If you’re dealing with a deadline—a lawsuit date, a garnishment, a repossession threat, or a foreclosure notice—mention that when you reach out. Timing can change the best next step.

For informational purposes only, not legal advice. The right strategy depends on your income, assets, debts, and goals. A consultation is the fastest way to get clarity on what applies to your situation and what to do next.

Mesa Bankruptcy FAQs

What does a Mesa AZ bankruptcy attorney review during a first consultation?

A first consultation is usually a “snapshot review” designed to give you clear direction quickly. We focus on the pressure you’re facing (collections, lawsuits, garnishments, repossession risk, or housing concerns), your income pattern (steady vs. fluctuating), your assets, and your main goal—like stopping a garnishment, keeping a vehicle, or getting a fresh start from unsecured debt. From there, we explain which bankruptcy path (if any) fits best and what timing or paperwork decisions matter most.

Can bankruptcy stop wage garnishments and collection lawsuits in Mesa?

In many cases, filing bankruptcy triggers an “automatic stay” that can pause most collection activity, including many wage garnishments and pending lawsuits. Because deadlines and payroll timing can matter, it helps to share any garnishment paperwork, lawsuit documents, and your most recent pay stubs during your consultation request. Some situations have exceptions, so getting advice early is the best way to avoid surprises.

What’s the difference between chapter 7 and chapter 13 for Mesa residents?

Mesa residents usually compare chapter 7 and chapter 13 based on the problem they’re trying to solve. chapter 7 is often explored when someone wants relief from unsecured debt and the eligibility numbers line up. chapter 13 is often explored when someone needs time to catch up on certain obligations or protect assets through a court-approved payment plan. The best fit depends on income, assets, debt type, and whether you’re trying to protect a home or vehicle.

What should I avoid doing right before filing bankruptcy in the East Valley?

Many complications come from last-minute moves that look harmless but create extra questions later—such as using credit right before filing (especially cash advances), transferring property or vehicle titles “for safekeeping,” or repaying family members. If bankruptcy is on the table, a helpful rule of thumb is to pause major financial moves and get guidance first. A short review can help you understand what to stop, what’s safe, and what documentation you’ll need.

What documents should I gather for a Mesa bankruptcy consultation request?

You don’t need perfect paperwork to start, but a few items can help you get clear answers faster: recent pay stubs or proof of income, a basic debt list (collections letters help), any lawsuit or garnishment paperwork, and your housing/vehicle payment details. If you have your most recent tax return, that can also help with planning and eligibility questions. If you’re missing something, you can still start—just share what you have and what deadlines you’re facing.

We Serve All of Arizona

We work with individuals and families across Arizona. No matter where you live, feel free to schedule a consultation. Phone or virtual appointments are available. Choose a city below to view local bankruptcy guidance, common concerns we see in that area, and next-step resources.